Participation of teachers of the Department of Accounting, Analysis and Control in the online marathon “Tax audits – what and who to expect?”

On April 4, 2023, teachers of the accounting, analysis and control department, associate professors – Ludmila Petryshyn, Anna Shot and Natalia Loboda* took part in the online marathon “Tax audits – what and who to expect?”. The headliner of the event is the State Tax Service of Ukraine.

The marathon is a social project of the Association of Lawyers of Ukraine and ID Legal Group. The moderator of the event was Anna Ignatenko – partner of ID Legal Group. Speakers were representatives of the Department of Tax Audit of the State Tax Service of Ukraine (hereinafter referred to as the Department): Tetyana Dotsenko – Director of the Department, Olena Krasulina – Deputy Director of the Department – Head of the Department of Tax Audits of the DPS of Ukraine; Oleksandr Senik is the head of the Department’s Department of Inspections of Legal Entities.

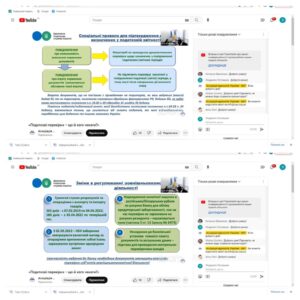

According to draft law 8401, which is under consideration in the Verkhovna Rada of Ukraine, from July 1, 2023, all tax audits that were stopped during martial law will be permanently returned. With this in mind, the questions for consideration were:

According to draft law 8401, which is under consideration in the Verkhovna Rada of Ukraine, from July 1, 2023, all tax audits that were stopped during martial law will be permanently returned. With this in mind, the questions for consideration were:

What should the business expect?

Consequences of taxpayers declaring a negative value from VAT?

VAT reimbursement based on the results of documentary verification.

Planned documentary checks.

What can taxpayers expect from July 1 by inclusion in the plan – the schedule of inspections for 2023.

TOP – 5 errors according to the results of inspections. What can be added for?

The clarity of what was said was shown by the presentation slides.

In addition, the listeners had the opportunity to ask their questions online, to which, at the end of the meeting, they received comprehensive answers from the representatives of the Department of Tax Control of the DPS of Ukraine.

At the end, all participants of the event expressed hope for the systematicity of such meetings to harmonize relations between control bodies in the field of taxation and taxpayers; improvement of professional competences of teachers of accounting disciplines, etc.

At the end, all participants of the event expressed hope for the systematicity of such meetings to harmonize relations between control bodies in the field of taxation and taxpayers; improvement of professional competences of teachers of accounting disciplines, etc.