Open lecture by Klepanchuk O. Yu. on the topic: “The cost of capital of the corporation”

On April 2, 2021, an open lecture on the subject “Corporations and Financial Infrastructure” was held for students of the UFF 31-33 groups by the lecturer of the Department of Financial Management, PhD, Associate Professor Olga Yuriyivna Klepanchuk.

The purpose of the lecture was to get acquainted with the methods of determining the value of capital and assets of the corporation taking into account the time factor, theories of determining the price of financial assets, the concepts of weighted average and marginal cost of capital, and understanding approaches to valuing share capital.

During the presentation of the lecture material were covered such issues as determining the value of capital and assets taking into account the time factor, the theory of determining the price of financial assets, weighted average and marginal value of capital, modern approaches to valuation of share capital.

The open lecture was attended by the head of the Department of Financial Management Prof. Sytnyk NS, teachers of the department prof. Vatamanyuk – Zelinska U.Z., Shushkova Yu.V., Tatarin N.B., Zakhidna O.R., Sich O.A., Popovych D.V., Sloboda L.Ya., Kozakevich O.R., Petyk L.O. etc.

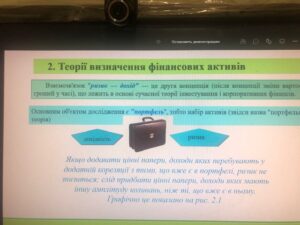

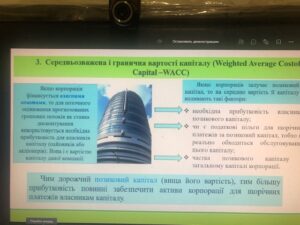

The lecturer emphasized that the main task of financial management of the corporation is to increase the value of share capital and, accordingly, increase the wealth of shareholders. The modern theory of investment, which was initiated by the appearance in 1952 of the article “Portfolio Choice” by the future Nobel Laureate (1990) American scientist G. Markovitsa. Weighted average cost of capital, which has important theoretical and practical significance as an indicator of the effectiveness of the financial function of the enterprise or organization in the formation of sources of financial resources. Different types of value of assets, property, business in general, which can be determined in the valuation process and used according to the needs of corporations.

At the end of the lecture there was a discussion of the results, during which the participants came to the conclusion that the lecture is widely filled with statistical, analytical and graphical materials, has mathematical calculations and enough examples. This allowed to confirm and specify the stated theoretical material. The topic of this lecture was relevant and there was a connection with the student audience, so this lesson was conducted at the appropriate methodological level.