Modern approaches to the implementation of the KYC principle and the development of the bank compliance system

On May 24, 2021, the Department of Finance hosted a scientific seminar “Modern approaches to the implementation of the principle of KYC and the development of the system of bank compliance.” The event was organized by Associate Professor Sloboda Larysa Yaroslavivna for the Day of Bank Employees of Ukraine for students majoring in “Finance, Banking and Insurance” and teachers of the department.

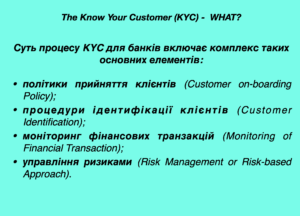

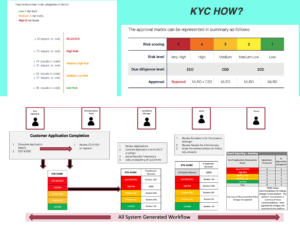

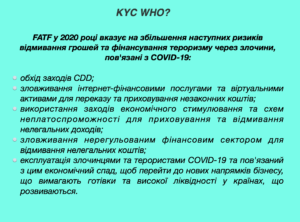

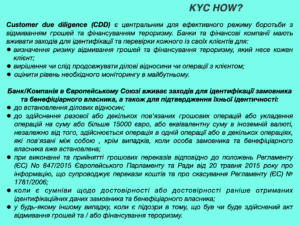

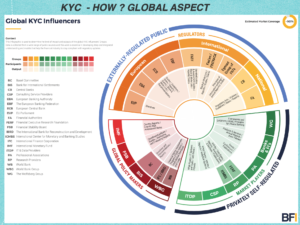

The speaker opened the issue of the peculiarities of conducting and financial compliance (and financial monitoring as its component) in financial institutions, noting that this area is also attractive for consulting companies operating globally, as compliance audit and support of compliance processes are one of the most expensive procedures for owners of financial corporations. Their use makes it possible to share the risks with regulators and to avoid fines or even revocation of licenses.

In the process of the report of Assoc. Sloboda L.Ya. noted that in modern conditions compliance risk is becoming important for Ukrainian banks, because a successful model of compliance risk management provides a high level of reputation of the bank, which increases its investment attractiveness and customer confidence. At the same time, the system of financial compliance itself is an important component of internal control over the activities of financial companies.

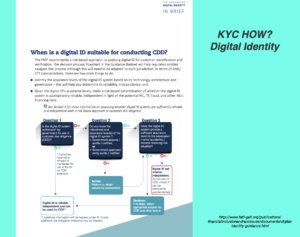

The speaker pointed out that, based on the practical experience of foreign financial institutions, it is mandatory to form a compliance program and compliance policy for banks and financial companies (payment institutions, electronic money companies, Fintech companies) in the field of obtaining a license to conduct financial activities; opening of correspondent accounts in banks for making payments of clients in SWIFT, SEPA systems.

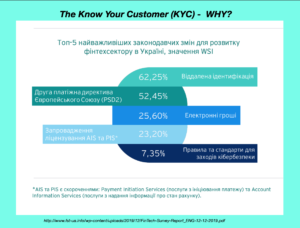

The presentation and practical examples provoked a lively discussion among teachers and students, active discussion, many interesting questions and valuable answers, which also allowed to “reveal” the secrets of regulatory risk and current innovations in Ukraine to conduct AML procedures and improve KYC in Ukrainian banks. in the context of European integration.